CEO MESSAGE

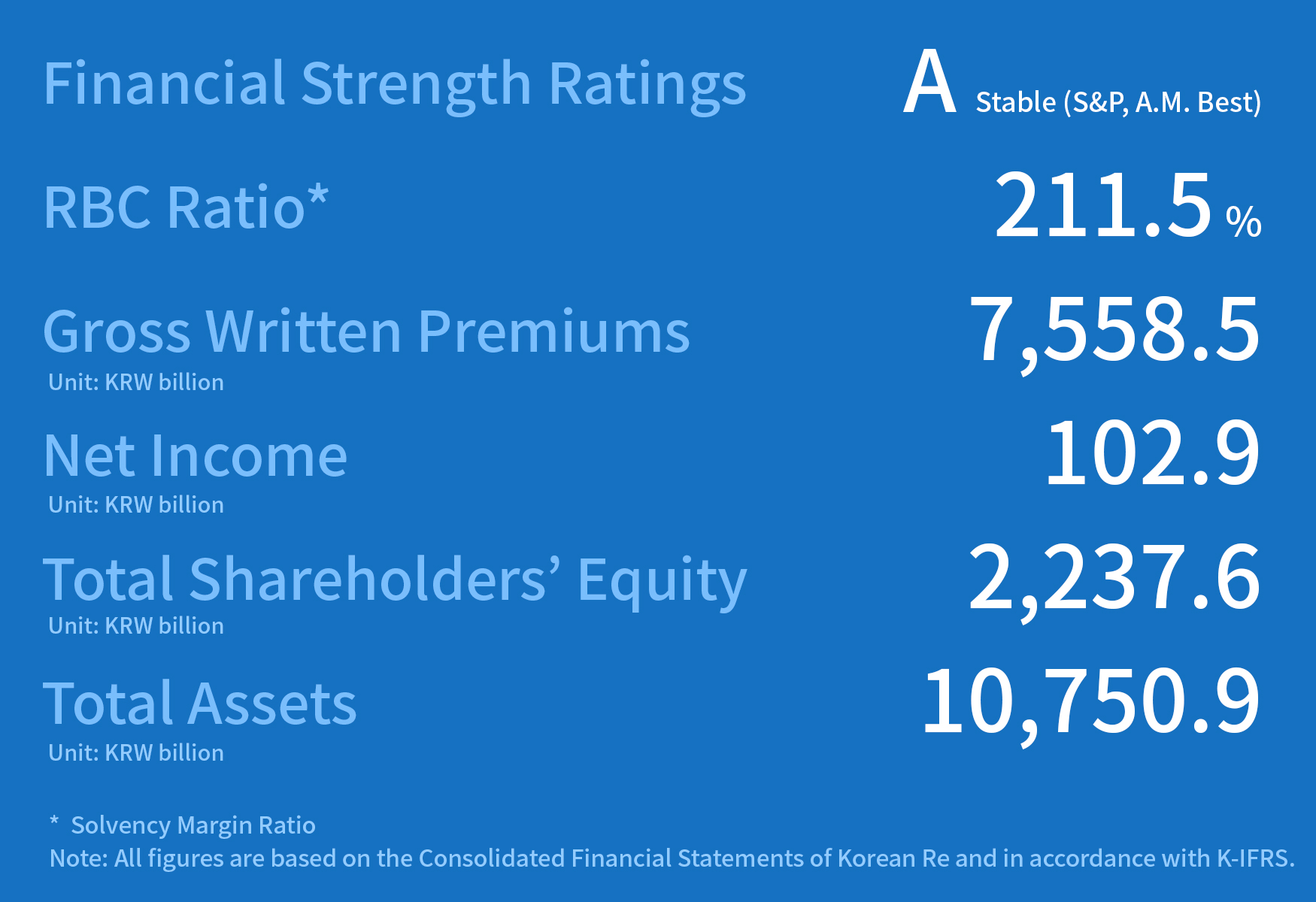

In 2018, Korean Re continued to deliver stable premium growth in spite of unfavorable market conditions, with gross written premiums increasing by 4.9 percent to KRW 7,558.5 billion.

We have come through a year that was filled with daunting challenges, such as adverse catastrophe experience and rapidly changing financial market conditions. The prolonged period of sluggish economic growth and low interest rates continued to pose a setback for the (re)insurance industry. Navigating an ever-evolving regulatory environment was another important challenge for the industry as the insurance supervisory landscape has been in a constant state of flux.